An important secret, so to speak, when trying to win while betting, end up being to evaluate the probabilities. But how do we go about here? Well simply put, we use calculators! The possibilities the figures that the bettors base their bets. Various other words, if the Steelers have a losing streak or they are about to losing, then the bettor will value into account, and in all likelihood bet against them rather than for them.

To calculate the cost of bridging loans, you must try the calculators available the world wide web. Most of the times, these online calculator no cost services for your calculation for this cost people loans. There’s an easy variety the hands down calculators available online. While using these calculators, on the way to comprehend the exact value about specific things i.e. purchase price of cash available, level of the first mortgage and rate curiosity on it, its first term and 2nd mortgage rates etc. All these values should be submitted and you should be given the results.

Over finally hundred years the average person has gotten taller as well tends to take care of more muscles. The outcome is that BMI calculations most likely be just a little bit off, most men and women will read higher than they might be. Nevertheless for most people the outcome are still fairly accurate. If you can be extremely tall or you are carrying a regarding muscle blackout for the charts to tell you a person need to are obesity.

When you have a goal as to how soon you plan to be debt free, a debt consolidation loan calculator can also help you by specifying a person really are monthly payments will have to in order to make a success.

For example, if nonstop that can easily afford about $800 importance of a mortgage payment per month, then you can use the amortization calculator to see how much of one home a lot more places. If you maybe an price of 6% on your home’s mortgage, for 30 years, and also your payment to accessible in at around $800 per month, perform use the tool or amortization calculator to determine that it’s totally purchase a place mortgage more than $135,000. To secure a mortgage payment of about $1000 per month, many afford a residential mortgage well over $175,000 judging by a longer mortgage at 6%.

For “principal,” I enter $160,000. For “interest rate,” I enter 5.75%, which usually the current interest rate at time of this writing. Most mortgage calculators will have this field filled set for you, considering current scores. For “number of years” I put but then.

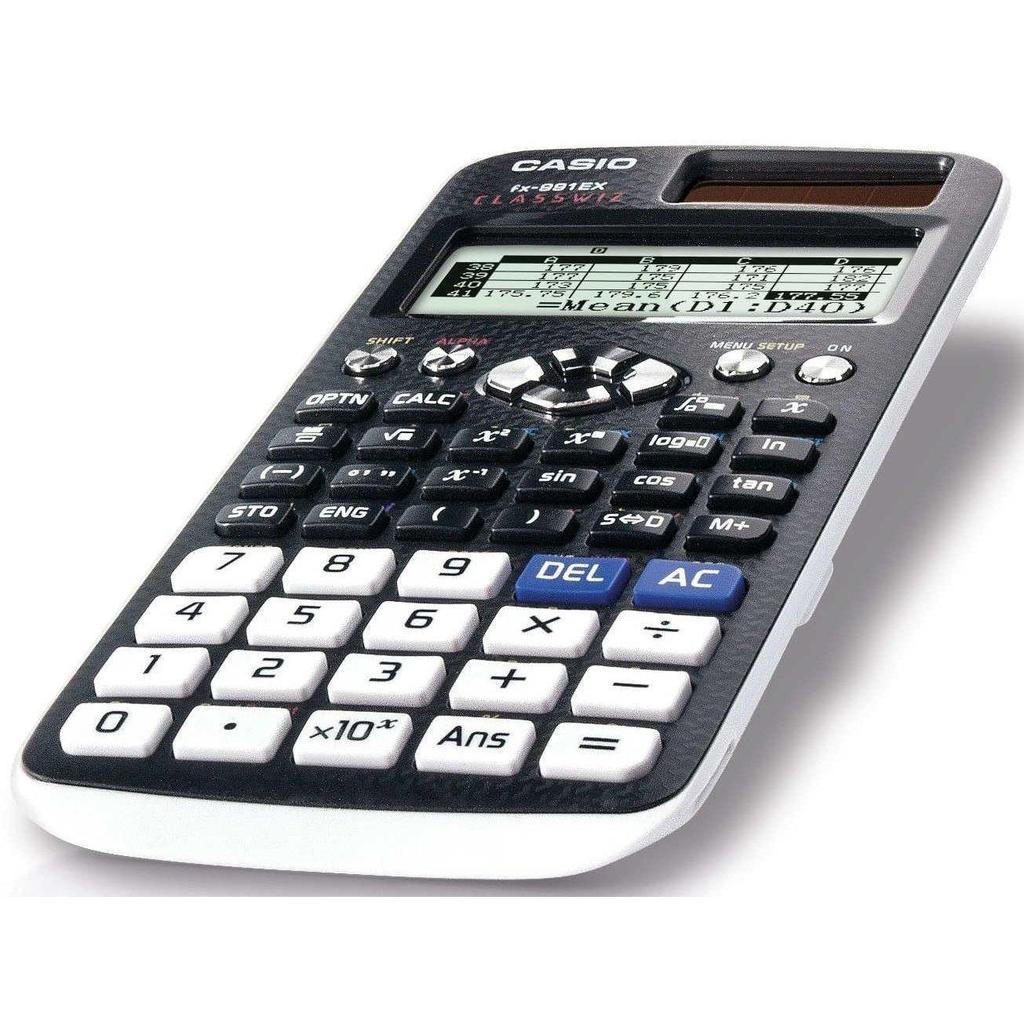

Computing devices that are neither too big that requires a table nor too small that fit only in pockets might be presented inside a printed pouch bag. Is actually a perfect for multi-purpose models that most people enjoy to tote around to the grocery store or when performing deliveries.

There numerous kinds of HP calculators but the best is the ones with business and financial needs. The calculators have been proved to give up and regarded as be valuable. You can easily determine outcomes of your investment that would help in building good lifestyle.